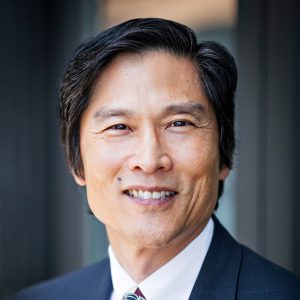

George, CTP, CIRA, is a managing principal in EMAGroup and leads the Business Restructuring and Enterprise Performance Improvement practices.

With over 30 years’ experience, George brings extensive expertise providing both financial and operational advice to primarily middle-market companies in transition, serving as Financial Advisor and Chief Restructuring Officer (“CRO”) to companies, private equity, and lenders. His background serving as a consulting partner in the large firm accounting and consulting firm environment for over 20 years provides unique “how to” implementation experience advising divisions of Fortune 500 companies and businesses with revenues ranging from $75M to $3B.

George has a unique ability to quickly and efficiently examine and remedy business issues with management and those involving supply chain, operations, and complex capital structures.

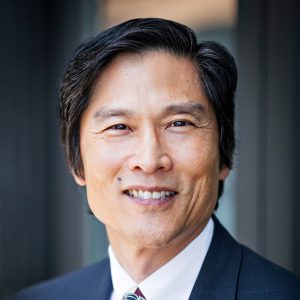

Cedric leads EMAGroup’s Capital Solutions practice and brings over 30 years of experience and leadership in mezzanine lending, distressed M&A, private equity, and serving as an operating partner helping investors and owners achieve targeted performance goals.

Cedric’s career includes stints at two Big 4 accounting firms, as an investor and operating partner in private equity, and in operating management roles for companies in transition.

Cedric heads EMAGroup’s Capital Solutions practice and primarily focuses on helping companies through the refinancing process in situations that range from a need for increased capital, company restructuring or business sale. His extensive understanding of business analytics are critical to evaluating root-cause issues, and invaluable in advising C-level executives on strategic and operational change-management initiatives.

Michael, CPA/CFF, CGMA, CIRA, CFE, leads the firm’s Insolvency Strategies practice which includes bankruptcy case management, out-of-court workouts, ABCs, debt restructurings, fiduciary roles, and forensic accounting & investigations.

While the focus of Michael’s work with EMAGroup is middle-market companies, he has over 30 years of experience working with a Big 4 accounting firm and private and public companies with revenues from $20 million to over $2 billion.

It is Michael’s extensive experience that gives him a unique ability to anticipate and solve lender, investor, and court-related issues before they become larger problems.

George is a senior executive with over 30 years of industry and consulting experience, performing financial and operational management for both financially distressed and high-growth companies.

He has been involved in numerous interim C-level roles to stabilize business operations, rebuild management teams, and prepare businesses for refinancing or sale. Previously, George worked in the large firm accounting and consulting environment for more than 20 years, which included serving as a partner and managing director in PricewaterhouseCoopers’ consulting and financial advisory services practices, and as the Western Regional Consulting Partner In-Charge for BDO Consulting.

George has a demonstrated background in working with management teams to help companies through difficult transition periods. He has successfully restructured and refinanced dozens of companies when the worst outcomes were expected by lenders, creditors, and investors.

Early in his career, George focused on business process re-engineering, post-acquisition integration and supply chain management for clients including divisions of Fortune 500 companies. Brand name clients have included Allergan International, Arco (AM/PM Stores and refinery distribution), Baskin-Robbins, Giorgio of Beverly Hills, Gateway Computers, Haagen Dazs, Herbalife International, International House of Pancakes (“IHOP”), MARS (Candy) Food, Monster Products, Smitty’s Super Valu, Nissan Motor Corp., Read-Rite Corporation, Technicolor, Warner Home Video, Tosco Corp/ConocoPhillips, and Unocal 76 Products, among others.

George is on the board of Methodist Hospital of Southern California, served on the board and as President for the Turnaround Management Association (TMA) – Southern California Chapter (2009-15), and continues to serve in National TMA roles. He received the 2015 Humanitarian Award from the National Jewish Health Foundation for community service and continues to serve as a National Trustee and supports other community charities.

George is a Certified Turnaround Professional (“CTP”) and a Certified Insolvency and Restructuring Advisor (“CIRA”). He earned his MBA in finance from the UCLA Anderson Graduate School of Management and his BA in economics and accounting from Claremont McKenna College.

Selected examples of George’s turnaround, operating and restructuring experience include the following situations:

Additional examples of experience:

George’s consulting experience includes manufacturing plant consolidations, materials handling infrastructure projects, supply chain/logistics, business process re-engineering, operational restructuring, financial and manufacturing systems implementation, post-acquisition integration, and working capital improvement for middle-market companies and divisions of Fortune 500 companies across multiple industries.

His restructuring experience includes numerous out-of-court workout cases which involved serving as crisis manager, Chief Restructuring Office (or Advisor) and business transformation agent, including preparation of turnaround plans, revised financial projections, and implementation programs to achieve improved profitability and cash flows to support negotiations with lenders and other parties-in-interest.

Sample engagements by industry sector:

Cedric J. Penix, MBA, is a Senior Advisor at EMAGroup. He has over 30 years of experience in finance, accounting, acquisitions, consulting and private equity.

Cedric leads EMAGroup’s Capital Solutions practice which focuses on helping companies through the refinancing process. EMAGroup’s clients’ needs range from requiring a simple refinancing to increasing liquidity availability and flexibility to more complicated financings that are part of a comprehensive restructuring and realignment of capital structure. Additionally, the restructuring process can often result in the sale or change of equity control. Cedric works with clients to optimize structuring and value.

Throughout his career, Cedric has assisted companies in transition whether as part of a capital raise, debt restructuring, sale transaction, or comprehensive strategic repositioning process. His experience includes working with stable businesses seeking out new initiatives, high-growth companies with working capital management issues, and distressed company situations involving business restructuring and turnaround initiatives. Cedric has extensive experience in business analytics critical to evaluating root-cause issues, and in advising C-level executives on strategic and operational change-management measures. His client support includes providing guidance and hands-on assistance in implementation of key operating initiatives.

Prior to joining EMAGroup as a senior advisor, Cedric was a Managing Director at Caymus Capital Group, LLC, and Executive Vice President/Partner at Fulcrum Capital Group, LLC, both private equity enterprises. As a private equity partner-in-charge of monitoring investments, he has been involved in interim C-Level advisory roles to assess operations and financial performance, managing senior and mezzanine lender relationships, business process restructuring, and preparation of companies for capital raise or sale process.

Cedric’s experience also includes business value-driver analysis, capital sourcing of mezzanine, equity and debt, pre-investment due diligence and diligence support, investment structuring/restructuring, and post-acquisition integration/implementation management.

Early in his career, Cedric was a Manager with PricewaterhouseCoopers’ Financial Advisory Services group, providing clients services including quality of earnings assessments, collateral base reviews, acquisition due diligence reviews, bankruptcy support, sell-side support, and occasionally, forensic accounting reviews. He also served as a senior auditor for Intermedics, Inc., a medical devices manufacturer, and Arthur Anderson, LLC, where he led and conducted financial audits, internal audits, business process reviews, gross margin/cost of sales analysis, inventory counts and valuations, organization efficiency reviews and other special projects as assigned.

Cedric currently serves as Chairman of the Board for a Los Angeles-based church and Board member for a local soccer league. He earned his MBA in finance and entrepreneurial studies from the UCLA Anderson Graduate School of Management and his BSBA in accounting from the University of Arkansas, Fayetteville.

COMPANY/DEBTOR RESTRUCTURINGS

While partner at Fulcrum Capital Partners, L.P. and Caymus Capital Group, served on investment committee, conducted or participated in pre-investment diligence and monitored portfolio company performance. Shown below are examples of specific experience:

Routinely interfaced with secured lenders to assure portfolio company compliance with covenants. When necessary, took definitive action to correct defaults.

Routinely assessed portfolio company management for competency, capability and capacity.

Investor representative to portfolio companies’ Boards of Directors.

LENDERS & BANK GROUPS

For a senior secured lender groups regarding their credit customers:

For a mezzanine lender regarding their credit customer (in addition to items above):

TRANSACTION ADVISORY SERVICES/SUPPORT

Served as a Manager at PricewaterhouseCoopers’ Financial Advisory Services Group. While there, provided multiple services for unique client types, including senior secured lenders, mezzanine lenders and private equity investors. Provided services for over 40 transactions in a three-year period.

Shown below are examples of selected transactions:

Michael M. Ozawa, CPA/CFF, CIRA, CFE, CGMA is a Managing Principal at EMAGroup and leads the firm’s insolvency practice.

He has over 30 years of experience in restructuring, insolvency, bankruptcy, and transaction advisory services, including overseeing the administration of dozens of companies in Chapter 11 on behalf of debtors, lenders, and creditors’ committees. Michael has also served fiduciary roles as Chapter 7 trustee, liquidating trustee, and independent board member.

Previously, Michael was a partner in the bankruptcy and restructuring group at PricewaterhouseCoopers (“PwC”) and a senior managing director in the corporate finance and restructuring group at FTI Consulting. He is a Certified Insolvency & Restructuring Advisor (“CIRA”), a Certified Public Accountant with a financial forensics specialization credential (“CPA/CFF”), a Certified Global Management Accountant (“CGMA”) and a Certified Fraud Examiner (“CFE”).

Clients have ranged from private companies with $20 million in revenue to public enterprises with revenues exceeding $2 billion. Michael has experience across many industries and sectors, including retail and consumer products, light manufacturing, food, logistics and distribution, software, technology, building products, automotive, airlines, financial services, and media and telecom.

Michael works side-by-side on a daily basis with senior management and operating teams to develop and coordinate execution of restructuring plans, coordinating with treasury on cash management and building out the framework for cash flow budgets, analysis and maintenance of 13-week rolling cash forecasts, helping negotiate with senior secured lenders and unsecured creditors, and coordinating with other restructuring professionals, such as attorneys, investment bankers and appraisers. In this regard, Michael focuses on relieving management of the cumbersome and time-consuming restructuring process, so that management can focus on core business operations.

Michael also manages capital sourcing mandates, sales processes, forensic accounting analyses/investigations, and litigation support matters. Related client services include sell-side quality of earnings (“QOE”), business plan reviews and preparation, due diligence support, sell-side due diligence support, review of company financial and operating results, coordination with other transaction professionals such investment bankers, alternative capital sources, diligence team, and helps manage the transaction structuring process.

Michael is a board member of the Turnaround Management Association Southern California Chapter, a member of the Association of Insolvency and Restructuring Advisors, the Los Angeles Bankruptcy Forum, the American Bankruptcy Institute, the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants. Michael earned his Bachelor of Arts degree in Economics – Business from the University of California at Los Angeles.

Below is a selection of Michael’s experience that provides a unique background in restructuring and insolvency matters. His experience permits him to provide added value for debtor clients by allowing him to anticipate and solve lender, investor, and court-related issues before they become larger problems. Michael’s capabilities are unmatched even among the biggest firms in the country thus allowing him to provide unparalleled experience for middle market clients.

COMPANY/DEBTOR RESTRUCTURINGS

LENDERS & BANK GROUPS

TRUSTEE & RELATED

TRANSACTION ADVISORY SERVICES

FORENSIC ASSIGNMENTS

SELECTED UNSECURED CREDITORS’ COMMITTEE ASSIGNMENTS

SELECTED DUE DILIGENCE / QUALITY OF EARNINGS EXPERIENCE

SELECTED LITIGATION AND FORENSIC ACCOUNTING EXPERIENCE